Page 151 - Quick Insights Book 2022

P. 151

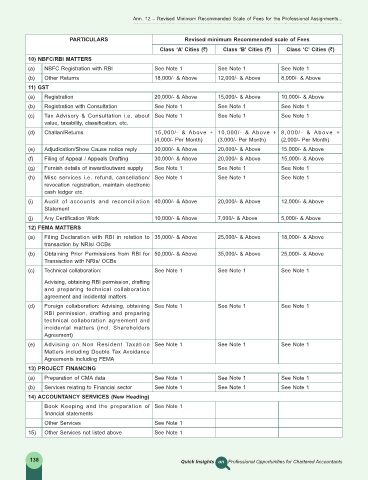

Ann. 12 – Revised Minimum Recommended Scale of Fees for the Professional Assignments...

PARTICULARS Revised minimum Recommended scale of Fees

Class ‘A’ Cities (`) Class ‘B’ Cities (`) Class ‘C’ Cities (`)

10) NBFC/RBI MATTERS

(a) NBFC Registration with RBI See Note 1 See Note 1 See Note 1

(b) Other Returns 18,000/- & Above 12,000/- & Above 8,000/- & Above

11) GST

(a) Registration 20,000/- & Above 15,000/- & Above 10,000/- & Above

(b) Registration with Consultation See Note 1 See Note 1 See Note 1

(c) Tax Advisory & Consultation i.e. about See Note 1 See Note 1 See Note 1

value, taxability, classification, etc.

(d) Challan/Returns 15,000/- & Above + 10,000/- & Above + 8,000/- & Above +

(4,000/- Per Month) (3,000/- Per Month) (2,000/- Per Month)

(e) Adjudication/Show Cause notice reply 30,000/- & Above 20,000/- & Above 15,000/- & Above

(f) Filing of Appeal / Appeals Drafting 30,000/- & Above 20,000/- & Above 15,000/- & Above

(g) Furnish details of inward/outward supply See Note 1 See Note 1 See Note 1

(h) Misc services i.e. refund, cancellation/ See Note 1 See Note 1 See Note 1

revocation registration, maintain electronic

cash ledger etc.

(i) Audit of accounts and reconciliation 40,000/- & Above 20,000/- & Above 12,000/- & Above

Statement

(j) Any Certification Work 10,000/- & Above 7,000/- & Above 5,000/- & Above

12) FEMA MATTERS

(a) Filing Declaration with RBI in relation to 35,000/- & Above 25,000/- & Above 18,000/- & Above

transaction by NRIs/ OCBs

(b) Obtaining Prior Permissions from RBI for 50,000/- & Above 35,000/- & Above 25,000/- & Above

Transaction with NRIs/ OCBs

(c) Technical collaboration: See Note 1 See Note 1 See Note 1

Advising, obtaining RBI permission, drafting

and preparing technical collaboration

agreement and incidental matters

(d) Foreign collaboration: Advising, obtaining See Note 1 See Note 1 See Note 1

RBI permission, drafting and preparing

technical collaboration agreement and

incidental matters (incl. Shareholders

Agreement)

(e) Advising on Non Resident Taxation See Note 1 See Note 1 See Note 1

Matters including Double Tax Avoidance

Agreements including FEMA

13) PROJECT FINANCING

(a) Preparation of CMA data See Note 1 See Note 1 See Note 1

(b) Services relating to Financial sector See Note 1 See Note 1 See Note 1

14) ACCOUNTANCY SERVICES (New Heading)

Book Keeping and the preparation of See Note 1

financial statements

Other Services See Note 1

15) Other Services not listed above See Note 1

138 Quick Insights on Professional Opportunities for Chartered Accountants