Page 148 - Quick Insights Book 2022

P. 148

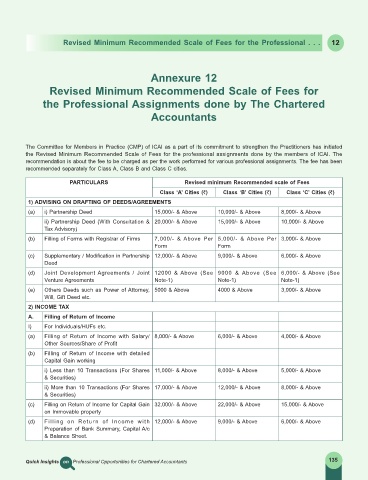

Revised Minimum Recommended Scale of Fees for the Professional . . . 12

Annexure 12

Revised Minimum Recommended Scale of Fees for

the Professional Assignments done by The Chartered

Accountants

The Committee for Members in Practice (CMP) of ICAI as a part of its commitment to strengthen the Practitioners has initiated

the Revised Minimum Recommended Scale of Fees for the professional assignments done by the members of ICAI. The

recommendation is about the fee to be charged as per the work performed for various professional assignments. The fee has been

recommended separately for Class A, Class B and Class C cities.

PARTICULARS Revised minimum Recommended scale of Fees

Class ‘A’ Cities (`) Class ‘B’ Cities (`) Class ‘C’ Cities (`)

1) ADVISING ON DRAFTING OF DEEDS/AGREEMENTS

(a) i) Partnership Deed 15,000/- & Above 10,000/- & Above 8,000/- & Above

ii) Partnership Deed (With Consultation & 20,000/- & Above 15,000/- & Above 10,000/- & Above

Tax Advisory)

(b) Filling of Forms with Registrar of Firms 7,000/- & Above Per 5,000/- & Above Per 3,000/- & Above

Form Form

(c) Supplementary / Modification in Partnership 12,000/- & Above 9,000/- & Above 6,000/- & Above

Deed

(d) Joint Development Agreements / Joint 12000 & Above (See 9000 & Above (See 6,000/- & Above (See

Venture Agreements Note-1) Note-1) Note-1)

(e) Others Deeds such as Power of Attorney, 5000 & Above 4000 & Above 3,000/- & Above

Will, Gift Deed etc.

2) INCOME TAX

A. Filling of Return of Income

I) For Individuals/HUFs etc.

(a) Filling of Return of Income with Salary/ 8,000/- & Above 6,000/- & Above 4,000/- & Above

Other Sources/Share of Profit

(b) Filling of Return of Income with detailed

Capital Gain working

i) Less than 10 Transactions (For Shares 11,000/- & Above 8,000/- & Above 5,000/- & Above

& Securities)

ii) More than 10 Transactions (For Shares 17,000/- & Above 12,000/- & Above 8,000/- & Above

& Securities)

(c) Filling on Return of Income for Capital Gain 32,000/- & Above 22,000/- & Above 15,000/- & Above

on Immovable property

(d) Filling on Return of Income with 12,000/- & Above 9,000/- & Above 6,000/- & Above

Preparation of Bank Summary, Capital A/c

& Balance Sheet.

Quick Insights on Professional Opportunities for Chartered Accountants 135