Page 149 - Quick Insights Book 2022

P. 149

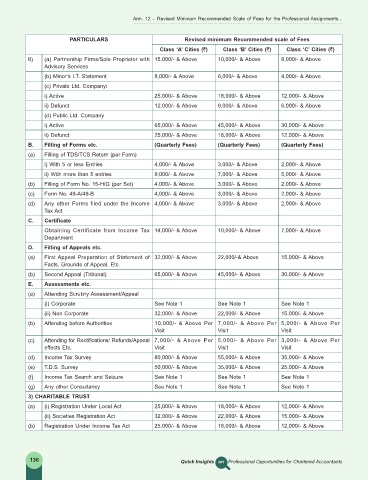

Ann. 12 – Revised Minimum Recommended Scale of Fees for the Professional Assignments...

PARTICULARS Revised minimum Recommended scale of Fees

Class ‘A’ Cities (`) Class ‘B’ Cities (`) Class ‘C’ Cities (`)

II) (a) Partnership Firms/Sole Proprietor with 15,000/- & Above 10,000/- & Above 8,000/- & Above

Advisory Services

(b) Minor’s I.T. Statement 8,000/- & Above 6,000/- & Above 4,000/- & Above

(c) Private Ltd. Company:

i) Active 25,000/- & Above 18,000/- & Above 12,000/- & Above

ii) Defunct 12,000/- & Above 9,000/- & Above 6,000/- & Above

(d) Public Ltd. Company

i) Active 65,000/- & Above 45,000/- & Above 30,000/- & Above

ii) Defunct 25,000/- & Above 18,000/- & Above 12,000/- & Above

B. Filling of Forms etc. (Quarterly Fees) (Quarterly Fees) (Quarterly Fees)

(a) Filling of TDS/TCS Return (per Form)

i) With 5 or less Entries 4,000/- & Above 3,000/- & Above 2,000/- & Above

ii) With more than 5 entries 9,000/- & Above 7,000/- & Above 5,000/- & Above

(b) Filling of Form No. 15-H/G (per Set) 4,000/- & Above 3,000/- & Above 2,000/- & Above

(c) Form No. 49-A/49-B 4,000/- & Above 3,000/- & Above 2,000/- & Above

(d) Any other Forms filed under the Income 4,000/- & Above 3,000/- & Above 2,000/- & Above

Tax Act

C. Certificate

Obtaining Certificate from Income Tax 14,000/- & Above 10,000/- & Above 7,000/- & Above

Department

D. Filling of Appeals etc.

(a) First Appeal Preparation of Statement of 32,000/- & Above 22,000/-& Above 15,000/- & Above

Facts, Grounds of Appeal, Etc.

(b) Second Appeal (Tribunal) 65,000/- & Above 45,000/- & Above 30,000/- & Above

E. Assessments etc.

(a) Attending Scrutiny Assessment/Appeal

(i) Corporate See Note 1 See Note 1 See Note 1

(ii) Non Corporate 32,000/- & Above 22,000/- & Above 15,000/- & Above

(b) Attending before Authorities 10,000/- & Above Per 7,000/- & Above Per 5,000/- & Above Per

Visit Visit Visit

(c) Attending for Rectifications/ Refunds/Appeal 7,000/- & Above Per 5,000/- & Above Per 3,000/- & Above Per

effects Etc. Visit Visit Visit

(d) Income Tax Survey 80,000/- & Above 55,000/- & Above 35,000/- & Above

(e) T.D.S. Survey 50,000/- & Above 35,000/- & Above 25,000/- & Above

(f) Income Tax Search and Seizure See Note 1 See Note 1 See Note 1

(g) Any other Consultancy See Note 1 See Note 1 See Note 1

3) CHARITABLE TRUST

(a) (i) Registration Under Local Act 25,000/- & Above 18,000/- & Above 12,000/- & Above

(ii) Societies Registration Act 32,000/- & Above 22,000/- & Above 15,000/- & Above

(b) Registration Under Income Tax Act 25,000/- & Above 18,000/- & Above 12,000/- & Above

136 Quick Insights on Professional Opportunities for Chartered Accountants