Page 118 - Quick Insights Book 2022

P. 118

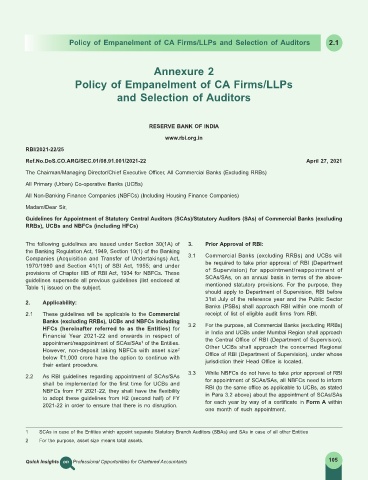

Policy of Empanelment of CA Firms/LLPs and Selection of Auditors 2.1

Annexure 2

Policy of Empanelment of CA Firms/LLPs

and Selection of Auditors

RESERVE BANK OF INDIA

www.rbi.org.in

RBI/2021-22/25

Ref.No.DoS.CO.ARG/SEC.01/08.91.001/2021-22 April 27, 2021

The Chairman/Managing Director/Chief Executive Officer, All Commercial Banks (Excluding RRBs)

All Primary (Urban) Co-operative Banks (UCBs)

All Non-Banking Finance Companies (NBFCs) (Including Housing Finance Companies)

Madam/Dear Sir,

Guidelines for Appointment of Statutory Central Auditors (SCAs)/Statutory Auditors (SAs) of Commercial Banks (excluding

RRBs), UCBs and NBFCs (including HFCs)

The following guidelines are issued under Section 30(1A) of 3. Prior Approval of RBI:

the Banking Regulation Act, 1949, Section 10(1) of the Banking

Companies (Acquisition and Transfer of Undertakings) Act, 3.1 Commercial Banks (excluding RRBs) and UCBs will

1970/1980 and Section 41(1) of SBI Act, 1955; and under be required to take prior approval of RBI (Department

provisions of Chapter IIIB of RBI Act, 1934 for NBFCs. These of Supervision) for appointment/reappointment of

guidelines supersede all previous guidelines (list enclosed at SCAs/SAs, on an annual basis in terms of the above-

Table 1) issued on the subject. mentioned statutory provisions. For the purpose, they

should apply to Department of Supervision, RBI before

31st July of the reference year and the Public Sector

2. Applicability:

Banks (PSBs) shall approach RBI within one month of

2.1 These guidelines will be applicable to the Commercial receipt of list of eligible audit firms from RBI.

Banks (excluding RRBs), UCBs and NBFCs including

HFCs (hereinafter referred to as the Entities) for 3.2 For the purpose, all Commercial Banks (excluding RRBs)

Financial Year 2021-22 and onwards in respect of in India and UCBs under Mumbai Region shall approach

appointment/reappointment of SCAs/SAs of the Entities. the Central Office of RBI (Department of Supervision).

1

However, non-deposit taking NBFCs with asset size Other UCBs shall approach the concerned Regional

2

below ₹1,000 crore have the option to continue with Office of RBI (Department of Supervision), under whose

their extant procedure. jurisdiction their Head Office is located.

3.3 While NBFCs do not have to take prior approval of RBI

2.2 As RBI guidelines regarding appointment of SCAs/SAs

shall be implemented for the first time for UCBs and for appointment of SCAs/SAs, all NBFCs need to inform

NBFCs from FY 2021-22, they shall have the flexibility RBI (to the same office as applicable to UCBs, as stated

to adopt these guidelines from H2 (second half) of FY in Para 3.2 above) about the appointment of SCAs/SAs

2021-22 in order to ensure that there is no disruption. for each year by way of a certificate in Form A within

one month of such appointment.

1 SCAs in case of the Entities which appoint separate Statutory Branch Auditors (SBAs) and SAs in case of all other Entities

2 For the purpose, asset size means total assets.

Quick Insights on Professional Opportunities for Chartered Accountants 105