Page 114 - Quick Insights Book 2022

P. 114

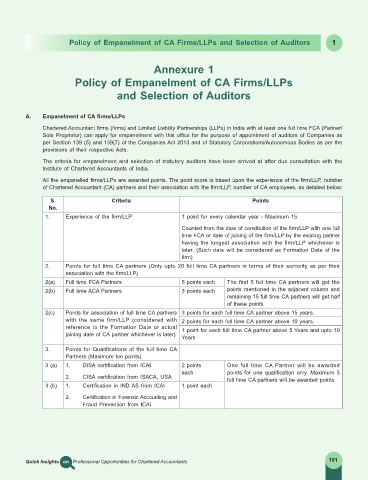

Policy of Empanelment of CA Firms/LLPs and Selection of Auditors 1

Annexure 1

Policy of Empanelment of CA Firms/LLPs

and Selection of Auditors

A. Empanelment of CA firms/LLPs

Chartered Accountant firms (firms) and Limited Liability Partnerships (LLPs) in India with at least one full time FCA (Partner/

Sole Proprietor) can apply for empanelment with this office for the purpose of appointment of auditors of Companies as

per Section 139 (5) and 139(7) of the Companies Act 2013 and of Statutory Corporations/Autonomous Bodies as per the

provisions of their respective Acts.

The criteria for empanelment and selection of statutory auditors have been arrived at after due consultation with the

Institute of Chartered Accountants of India.

All the empanelled firms/LLPs are awarded points. The point score is based upon the experience of the firm/LLP, number

of Chartered Accountant (CA) partners and their association with the firm/LLP, number of CA employees, as detailed below:

S. Criteria Points

No.

1. Experience of the firm/LLP 1 point for every calendar year - Maximum 15.

Counted from the date of constitution of the firm/LLP with one full

time FCA or date of joining of the firm/LLP by the existing partner

having the longest association with the firm/LLP whichever is

later. (Such date will be considered as Formation Date of the

firm)

2. Points for full time CA partners (Only upto 20 full time CA partners in terms of their seniority as per their

association with the firm/LLP)

2(a) Full time FCA Partners 5 points each The first 5 full time CA partners will get the

2(b) Full time ACA Partners 3 points each points mentioned in the adjacent column and

remaining 15 full time CA partners will get half

of these points

2(c) Points for association of full time CA partners 3 points for each full time CA partner above 15 years.

with the same firm/LLP (considered with 2 points for each full time CA partner above 10 years.

reference to the Formation Date or actual 1 point for each full time CA partner above 5 Years and upto 10

joining date of CA partner whichever is later)

Years

3. Points for Qualifications of the full time CA

Partners (Maximum ten points)

3 (a) 1. DISA certification from ICAI 2 points One full time CA Partner will be awarded

each points for one qualification only. Maximum 5

2. CISA certification from ISACA, USA full time CA partners will be awarded points

3 (b) 1. Certification in IND AS from ICAI 1 point each

2. Certification in Forensic Accounting and

Fraud Prevention from ICAI

Quick Insights on Professional Opportunities for Chartered Accountants 101