Page 130 - Quick Insights Book 2022

P. 130

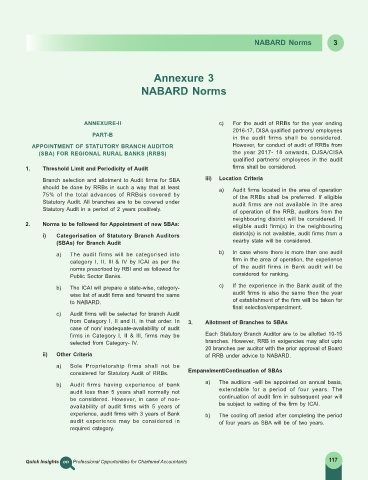

NABARD Norms 3

Annexure 3

NABARD Norms

ANNEXURE-II c) For the audit of RRBs for the year ending

2016-17, DISA qualified partners/ employees

PART-B in the audit firms shall be considered.

APPOINTMENT OF STATUTORY BRANCH AUDITOR However, for conduct of audit of RRBs from

(SBA) FOR REGIONAL RURAL BANKS (RRBS) the year 2017- 18 onwards, DJSA/CISA

qualified partners/ employees in the audit

1. Threshold Limit and Periodicity of Audit firms shall be considered.

Branch selection and allotment to Audit firms for SBA iii) Location Criteria

should be done by RRBs in such a way that at least a) Audit firms located in the area of operation

75% of the total advances of RRBsis covered by of the RRBs shall be preferred. If eligible

Statutory Audit. All branches are to be covered under audit firms are not available in the area

Statutory Audit in a period of 2 years positively. of operation of the RRB, auditors from the

neighbouring district will be considered. If

2. Norms to be followed for Appointment of new SBAs: eligible audit firm(s) in the neighbouring

i) Categorisation of Statutory Branch Auditors district(s) is not available, audit firms from a

(SBAs) for Branch Audit nearby state will be considered.

a) The audit firms will be categorised into b) In case where there is more than one audit

category I, II, Ill & IV by ICAI as per the firm in the area of operation, the experience

norms prescribed by RBI and as followed for of the audit firms in Bank audit will be

Public Sector Banks. considered for ranking.

b) The ICAI will prepare a state-wise, category- c) If the experience in the Bank audit of the

wise list of audit firms and forward the same audit firms is also the same then the year

to NABARD. of establishment of the firm wiII be taken for

final selection/empanclment.

c) Audit firms will be selected for branch Audit

from Category I, II and II, in that order. In 3. Allotment of Branches to SBAs

case of non/ inadequate-availability of audit

firms in Category I, II & Ill, firms may be Each Statutory Branch Auditor are to be allotted 10-15

selected from Category- IV. branches. However, RRB in exigencies may allot upto

20 branches per auditor with the prior approval of Board

ii) Other Criteria of RRB under advice to NABARD.

a) Sole Proprietorship firms shall not be

considered for Statutory Audit of RRBs. Empanelment/Continuation of SBAs

b) Audit firms having experience of bank a) The auditors -will be appointed on annual basis,

audit less than 5 years shall normally not extendable for a period of four years. The

be considered. However, in case of non- continuation of audit firm in subsequent year will

availability of audit firms with 5 years of be subject to vetting of the firm by ICAI.

experience, audit firms with 3 years of Bank b) The cooling off period after completing the period

audit experience may be considered in of four years as SBA will be of two years.

required category.

Quick Insights on Professional Opportunities for Chartered Accountants 117