Page 186 - Quick Insights Book 2022

P. 186

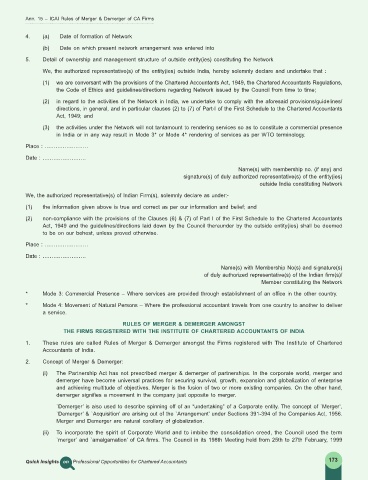

Ann. 15 – ICAI Rules of Merger & Demerger of CA Firms

4. (a) Date of formation of Network

(b) Date on which present network arrangement was entered into

5. Detail of ownership and management structure of outside entity(ies) constituting the Network

We, the authorized representative(s) of the entity(ies) outside India, hereby solemnly declare and undertake that :

(1) we are conversant with the provisions of the Chartered Accountants Act, 1949, the Chartered Accountants Regulations,

the Code of Ethics and guidelines/directions regarding Network issued by the Council from time to time;

(2) in regard to the activities of the Network in India, we undertake to comply with the aforesaid provisions/guidelines/

directions, in general, and in particular clauses (2) to (7) of Part-I of the First Schedule to the Chartered Accountants

Act, 1949; and

(3) the activities under the Network will not tantamount to rendering services so as to constitute a commercial presence

in India or in any way result in Mode 3* or Mode 4* rendering of services as per WTO terminology.

Place : ……………………

Date : ……………………

Name(s) with membership no. (if any) and

signature(s) of duly authorized representative(s) of the entity(ies)

outside India constituting Network

We, the authorized representative(s) of Indian Firm(s), solemnly declare as under:-

(1) the information given above is true and correct as per our information and belief; and

(2) non-compliance with the provisions of the Clauses (6) & (7) of Part I of the First Schedule to the Chartered Accountants

Act, 1949 and the guidelines/directions laid down by the Council thereunder by the outside entity(ies) shall be deemed

to be on our behest, unless proved otherwise.

Place : ……………………

Date : ……………………

Name(s) with Membership No(s) and signature(s)

of duly authorized representative(s) of the Indian firm(s)/

Member constituting the Network

* Mode 3: Commercial Presence – Where services are provided through establishment of an office in the other country.

* Mode 4: Movement of Natural Persons – Where the professional accountant travels from one country to another to deliver

a service.

RULES OF MERGER & DEMERGER AMONGST

THE FIRMS REGISTERED WITH THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

1. These rules are called Rules of Merger & Demerger amongst the Firms registered with The Institute of Chartered

Accountants of India.

2. Concept of Merger & Demerger:

(i) The Partnership Act has not prescribed merger & demerger of partnerships. In the corporate world, merger and

demerger have become universal practices for securing survival, growth, expansion and globalization of enterprise

and achieving multitude of objectives. Merger is the fusion of two or more existing companies. On the other hand,

demerger signifies a movement in the company just opposite to merger.

`Demerger’ is also used to describe spinning off of an “undertaking” of a Corporate entity. The concept of `Merger’,

`Demerger’ & `Acquisition’ are arising out of the `Arrangement’ under Sections 391-394 of the Companies Act, 1956.

Merger and Demerger are natural corollary of globalization.

(ii) To incorporate the spirit of Corporate World and to imbibe the consolidation creed, the Council used the term

`merger’ and `amalgamation’ of CA firms. The Council in its 198th Meeting held from 25th to 27th February, 1999

Quick Insights on Professional Opportunities for Chartered Accountants 173