Page 180 - Quick Insights Book 2022

P. 180

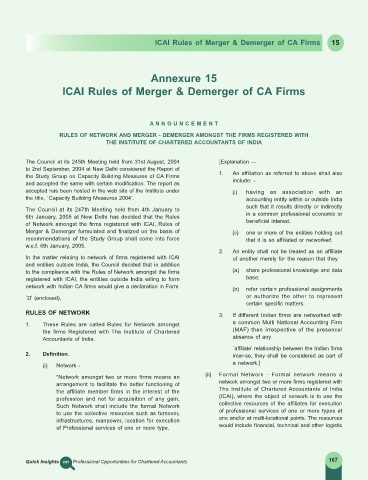

ICAI Rules of Merger & Demerger of CA Firms 15

Annexure 15

ICAI Rules of Merger & Demerger of CA Firms

A N N O U N C E M E N T

RULES OF NETWORK AND MERGER - DEMERGER AMONGST THE FIRMS REGISTERED WITH

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

The Council at its 245th Meeting held from 31st August, 2004 [Explanation —

to 2nd September, 2004 at New Delhi considered the Report of

the Study Group on Capacity Building Measures of CA Firms 1. An affiliation as referred to above shall also

and accepted the same with certain modification. The report as include: -

accepted has been hosted in the web site of the Institute under (i) having an association with an

the title, `Capacity Building Measures 2004’. accounting entity within or outside India

The Council at its 247th Meeting held from 4th January to such that it results directly or indirectly

6th January, 2005 at New Delhi has decided that the Rules in a common professional economic or

of Network amongst the firms registered with ICAI, Rules of beneficial interest.

Merger & Demerger formulated and finalized on the basis of (ii) one or more of the entities holding out

recommendations of the Study Group shall come into force that it is so affiliated or networked.

w.e.f. 6th January, 2005.

2. An entity shall not be treated as an affiliate

In the matter relating to network of firms registered with ICAI of another merely for the reason that they

and entities outside India, the Council decided that in addition

to the compliance with the Rules of Network amongst the firms (a) share professional knowledge and data

registered with ICAI, the entities outside India wiling to form base;

network with Indian CA firms would give a declaration in Form (b) refer certain professional assignments

`D’ (enclosed). or authorize the other to represent

certain specific matters.

RULES OF NETWORK 3. If different Indian firms are networked with

1. These Rules are called Rules for Network amongst a common Multi National Accounting Firm

the firms Registered with The Institute of Chartered (MAF) then irrespective of the presence/

Accountants of India. absence of any

`affiliate’ relationship between the Indian firms

2. Definition. inter-se, they shall be considered as part of

(i) Network - a network.]

“Network amongst two or more firms means an (ii) Formal Network - Formal network means a

arrangement to facilitate the better functioning of network amongst two or more firms registered with

the affiliate member firms in the interest of the The Institute of Chartered Accountants of India

profession and not for acquisition of any gain. (ICAI), where the object of network is to use the

Such Network shall include the formal Network collective resources of the affiliates for execution

to use the collective resources such as turnover, of professional services of one or more types at

infrastructures, manpower, location for execution one and/or at multi-locational points. The resources

of Professional services of one or more type. would include financial, technical and other logistic

Quick Insights on Professional Opportunities for Chartered Accountants 167